You now solicit what kind from things that you can profit by having a good credit score. Above all else, a good credit score can expand your odds of getting the loan you apply for, and besides, it will help you land certain positions and projects that will require a good credit score. These are the two principle reasons why you need good credit score.

Be that as it may, if you are tormented with bad credit score previously, you now ask how you all can get good credit score again or how you can repair your credit score. It is vital to understand the way that on the off chance that you have a bad credit score, you should correct it as quickly as time permits before your credit score turns out to be much more terrible.

Repairing bad credit score will oblige you to have tolerance and furthermore a little luck. It is something that you ought to do with the end goal for you to live serenely and furthermore somewhat simpler for you and your family. By repairing your bad credit score as quickly as time permits, you will never pass up a great opportunity for any more incredible open doors that will cross your way later on.

Before you go on and begin repairing your bad credit score, you initially need to comprehend what matters to credit. You need to know how it can influence your life. For instance, if you need a loan, moneylenders will investigate your credit rating to decide whether you can endorse for the loan. An excellent credit score will guarantee the banks that you pay your loans before the due date and consequently, will ensure them that you will have the capacity to pay the loan you will apply. The same goes when you are applying for a credit card.

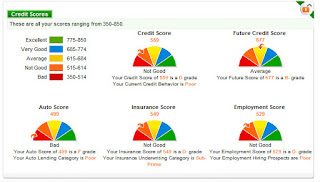

Since you comprehend having an excellent credit rating, the following thing you have to do is to decide whether you have a good credit score or not. Shockingly, very few individuals know whether they have a good credit score or if they have a bad credit rating. To think about your credit score, you can just request it in a few credit detailing organizations. They will have the capacity to give you a numerical marker of how much your credit rating rates and how much credit hazard you are.

On the off chance that the tag says that you have a high score, this implies you have a good credit score, if you all have a lower score, then it will demonstrate that you have a bad credit score and will be significantly more hazardous to get endorsed of for loans.

Along these lines, if you have a bad credit rating, the principal thing you have to do to enhance your credit score is to deal with old obligations. By paying all your old debts, this will stop the creditors to quit making negative reports to credit announcing offices.

This is the main thing you need to do with a specific end goal to prevent your credit score from deteriorating then it as of now is. By cutting the wellspring of negative credit reports, you will be well on your approach to get a good credit score.

In order for any event to be implemented properly, do not forget to make a shirt with a design that fits the event. Therefore, the success of an event can support either before or after the event takes place. If you want to create a t-shirt with a design in accordance with the wishes of you, please click the information here

In any case, paying every one of your obligations doesn't imply that you will immediately get an excellent credit rating. You need to recall that this will simply prevent it from deteriorating. Your old bad credit score will at present be there. Thus, apparently, the next stride is begun searching for approaches to make some positive reports on your credit rating.

You can do this by applying for a credit card that is intended for individuals who have bad credit score, for example, a secured credit card. You ought to likewise begin opening another investment account or financial records. Never forget that you ought to pay your balance on time with the end goal for you to set up a positive credit report.

In the long run, your old bad credit score will terminate in time. Continuously continue paying your obligations on time, and your credit history will look superior to before. In any case, it will more often than not take around 5 to 7 years for your old credit report with negative reports to lapse. This is the reason tolerance is vital.

With tolerance, you will see that in time, your credit score will rise and dispose of those negative reports that you had previously. Never forget to continue paying your obligations on time so as to proceed to have a good credit score.